are inherited annuity distributions taxable

If planned well this taxable IRD gain amount can be spread over many years after the death of the annuity owner in the form of an inherited non-qualified annuity. How inherited annuities are taxed depends on their payout structure and whether the one inheriting the annuity is the surviving spouse or someone else.

The 6 Types Of Itemized Deductions That Can Still Be Claimed After Tcja Https Www Kitces Com Blog Itemized Deducti Deduction Inherited Ira Standard Deduction

The earnings on an inherited annuity are taxable.

. Written by Hersh Stern Updated Tuesday March 22 2022 Postpone RMDs with a QLAC. RMD withdrawals however are NOT required to be taken from a non-qualified annuity. That means you may have to pay an additional 10 federal tax for premature distributions in addition to income taxes on withdrawals before you turn 59½ unless an exception applies and youll generally have to take annual required minimum.

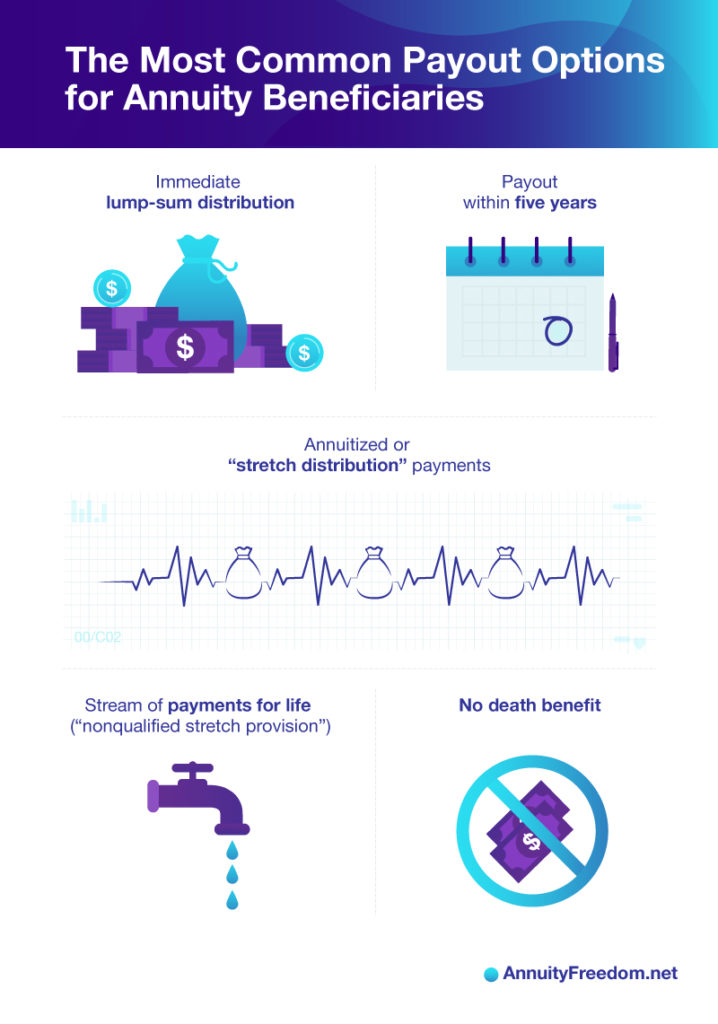

The inherited annuitys remaining funds can be withdrawn in a single payment if desired. When a person inherits an annuity the gains stay with the policy. If you inherit a Roth IRA youre free of taxes.

Inherited IRA rules for non-spouses. You will receive Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc which reports your total distribution amount taxable amount and any tax withholding taken. In general distributions from a traditional IRA are taxable in the year you receive them.

Figure the taxable amount of the inherited traditional IRA distribution using the Retirement Plan Distributions Worksheet after entering the distribution on Form 1099-R. An inherited annuity can be a welcome windfall or a potential liability. If you invest in a retirement annuity that is not part of an employer-sponsored program or a commonly recognized retirement program you may have PA taxable income when you begin receiving annuity payments.

This strategy was known as the Stretch IRA In some cases beneficiaries would simply take the original owner. The distribution may be subject to additional taxes or penalties. An inherited IRA may be taxable depending on the type.

If you inherit an annuity be sure you find an expert who can help. An annuity is qualified if you purchase it with pre-tax dollars via a tax-advantaged account such as an IRA or 401k. If youve inherited an IRA on or after January 1 2020 and you cannot stretch your distributions you must withdraw all assets from the inherited account within.

See Tax on Early Distributions later. The IRS treats distributions paid to an annuitant from qualified annuities as taxable income in the year they are received. Annuity distributions from an insurance company.

For more information about rollovers required distributions and inherited IRAs see. In the past a beneficiary could take distributions over their lifetime. This rule applies for determining if the annuity qualifies for exemption from the tax on early distributions as an immediate annuity.

Depending on the type of annuity the tax will have to be paid on the lump. Here is a detailed summary of the distribution options available to spouses non-spouses and trusts for inherited non-qualified annuities under IRC Section 72s. The SECURE Act changed the inherited IRA rules for beneficiaries who werent married to the original account owner.

Most retirees dont need to tap their Traditional IRA early in retirement but are forced to because of Required Minimum Distributions RMDs. In either case the tax treatment of the IRA funds that you inherit generally will be based on your age not your spouses. For information on figuring your gain and reporting it in income see Are Distributions Taxable earlier.

Once you reach RMD age you must take money from your IRA each year. QLAC Qualified Longevity Annuity Contract. File a paper return and include all copies of Forms 1099-R and 8606.

This strategy primarily involves a non-spouse inherited annuity and this inherited annuity stretch option allows you to receive RMDs Required Minimum Distributions based on your life expectancy. You can take a lump-sum distribution from an inherited Roth IRA or an inherited Roth 401k403b457b account but since qualified distributions from these plans are tax free and nonqualified distributions are taxable only to the extent earnings are distributed the considerations are quite different. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death.

If you acquire an annuity contract in a tax-free exchange for another annuity contract its date of purchase is the date you purchased the annuity you exchanged. Also crucial is whether the account is a traditional or Roth IRA as the basis may. You must report the amount reported as taxable for federal income tax purposes as taxable interest on a PA Schedule A.

At the time you receive the benefits youll have to pay any taxes that are payable. IRAs with annuity holdings are subject to the IRS rule known as required minimum distributions RMDs which triggers when an individual reaches the age of 70 ½. Qualified annuities are also required to follow required minimum distribution rules.

For many who inherit IRAs or 401ks starting in 2020 the SECURE Act eliminated the ability to stretch your taxable distributions and related tax payments over your life expectancy. But with a traditional IRA any amount you withdraw is. Knowing the basis of an inherited IRA can prevent the beneficiary from paying unnecessary taxes on distributions.

A nonqualified variable annuity allows you to defer taxes on your investment gains but doesnt entitle you to a tax deduction as a qualified plan does. It is possible to pay taxes on inherited annuity payments over the course of five years using the 5-year rule.

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Taxation How Various Annuities Are Taxed

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

![]()

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

3 Basic Options Inherited Qualified Annuity Mintco Financial

Annuity Beneficiaries Inheriting An Annuity After Death

Stretch Iras Are Now A Thing Of The Past Due To A New 10 Year Rule That Affects Non Spousal Beneficiaries Of An Inherit Inherited Ira Financial Education Ira

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

Council Post Why Non Recourse Loans Aren T Always Non Recourse Second Mortgage Loan Company Credit Companies

Annuity Beneficiaries Inherited Annuities Death

Inherited Annuities What Are My Options The Annuity Expert 2022